NDC gov't successfully recapitalises National Investment Bank

NIB logo

NIB logo

The National Democratic Congress (NDC) government has chalked a major milestone with the successful recapitalisation of the struggling National Investment Bank (NIB), restoring the financial health and stability of the state-owned bank.

Presenting the 2025 Mid-Year Budget Review in Parliament, Finance Minister Dr. Cassiel Ato Forson announced that NIB is now fully capitalised, following the implementation of a government-approved GH¢2.3 billion recapitalisation plan.

According to the Minister, the bank received a comprehensive financial package comprising GH¢450 million in direct cash injection, GH¢1.5 billion in bonds, and GH¢500 million in government shares in Nestlé Ghana Limited.

The first tranche of GH¢400 million was transferred to NIB earlier this year.

As a result of the recapitalisation, NIB’s capital adequacy ratio surged from a distressing -53.13% in June 2024 to a healthy +23% as of May 2025.

The bank’s total paid-up capital now stands at GH¢3.4 billion.

Dr. Ato Forson highlighted that the intervention not only saved over GH¢6.4 billion in depositor funds but also preserved more than 900 direct jobs, marking a significant win for Ghana’s financial sector.

He emphasised the government’s unwavering commitment to maintaining the financial stability and long-term sustainability of NIB.

A comprehensive restructuring plan is currently underway, aimed at strengthening corporate governance, improving risk management, enhancing transparency, and ensuring strategic decision-making.

Looking ahead, the government intends to list NIB on the Ghana Stock Exchange, a move that is expected to enhance the bank’s access to capital and deepen investor confidence.

The successful recapitalisation is seen as a key achievement under the NDC’s economic recovery agenda and a critical step toward restoring trust in state-owned financial institutions, he said

Trending Business

E/R: Lotus Mining Group denies illegal mining allegations, reaffirms commitment to community development

10:49

NPA dismisses reports of aviation fuel shortage, assures adequate supply

03:36

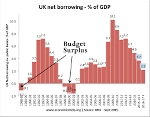

Primary surplus rises to 11.1% of GDP, signalling economic stability - Ato Forson

15:13

Buffers needed to cushion us against fiscal and external shocks -Ato Forson

14:48

Ato Forson: We inherited a bleeding energy sector with annual shortfalls over $1.5bn

14:40

Energy Ministry dismisses reports of aviation fuel shortage, assures steady supply

14:30

TAGG President calls for port tariff standardisation ahead of Mid-year Budget Review

13:00

Canal+ secures approval for $2.82bn MultiChoice takeover

11:21

NPA holds second stakeholder consultation on draft consumer complaints guidelines for petroleum sector

10:17

Mid-year Budget Review: Okaikwei Central MP hints at key tax increases

04:06