IBAG reflects on a “mixed year” as industry records major wins

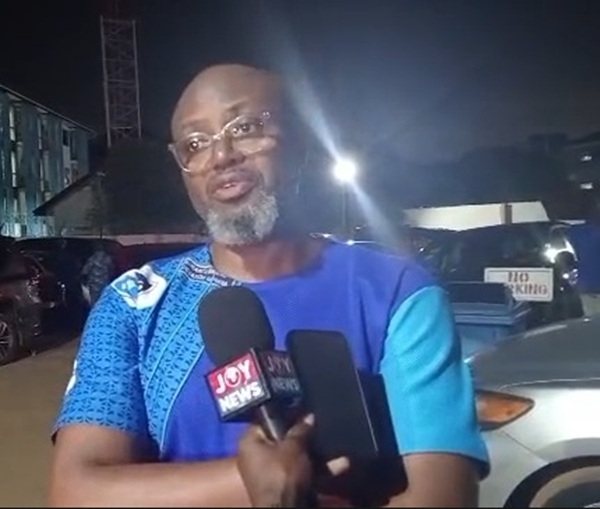

Shalbu Ali

Shalbu Ali

The immediate past President of the Insurance Brokers Association of Ghana (IBAG), Shalbu Ali, has described 2025 as a year of mixed fortunes for the insurance brokerage industry, marked by significant challenges alongside notable gains.

Speaking on his biggest wins and challenges after an Annual General Meeting and elections held in Accra, Mr. Ali said the year experienced “ups and downs,” largely due to the introduction of the Value Added Tax (VAT) on insurance, which negatively affected policy uptake across the industry.

According to him, the 22 per cent VAT on insurance products came at a difficult time when many individuals and organisations had already finalised their budgets.

As a result, several insurance policies were either reduced or cancelled, leading to a noticeable decline in the number of people taking up insurance cover.

“The VAT on insurance had a significant impact on policy numbers.

It was one of the key low points for us as an industry,” he stated, noting that many brokers recorded a reduction in business during the year.

Despite these setbacks, Mr. Ali highlighted several achievements that he described as major high points for IBAG.

Chief among them is the Association’s growth in membership, particularly on the wingside, as well as the successful acquisition of a property at Kanda in Accra.

“For me, the acquisition of our own property at Kanda is one of the highest points.

Having our own office location will help the Association in many ways going forward,” he said.

Another milestone mentioned was the establishment of the Ghana Insurance Industry Credit Union, which has recorded impressive growth within a short period.

Mr. Ali revealed that as of 8:00am on the day of his address, the credit union had over 400 shareholders with a total share value of GHS1.6 million.

“This is very impressive and shows the confidence members have in the initiative,” he added.

On international exposure, the outgoing IBAG president disclosed that the Association facilitated a business trip for 70 insurance brokers from Ghana to Dubai to engage with brokers in the Dubai market and build professional relationships.

He noted that a similar initiative two years ago saw about 65 brokers travel to London, with participation increasing in the recent Dubai visit.

“These engagements have helped develop strong relationships with international markets, which is a big plus for our members,” he said.

Reflecting on the overall performance of the year, Mr. Ali said it was difficult to categorise 2025 as entirely good or bad, given the circumstances.

“Most people saw a reduction in business, but as a collective industry, we are hopeful,” he noted.

Looking ahead, he expressed optimism about 2026, indicating that companies are expected to budget more effectively for insurance products.

He added that IBAG does not anticipate a further decline in insurance uptake and remains hopeful of welcoming more new members in the coming year.“We look forward to a better 2026,” Mr. Ali concluded.

Trending Business

Muntaka Entrepreneurship Hub trains over 100 women in Asawase

14:16

Ghana Gold Board rakes in over $10bn ahead of target

09:56

GEXIM faces GHS1.5bn credit exposure as NPLs near 30% — CEO

09:36

Six Degrees delivers immersive experiential production at Kweku Smoke’s revival concert

10:37

GIPC highlights govt’s commitment to retail sector transformation at GUTA conference

03:01

Lower-Volta Small-Scale Miners & Farmers to host international livestock market

00:43

Nigeria's commercial dispute involving Ghanaian firm raises bilateral trade concerns-UK Certified Customer Communication expert warns

21:31

GoldBod Jewellery, GTA launches December homecoming promotion for diaspora visitors

17:15

Global cocoa prices soared, but Ghanaian farmers gained little – Randy Abbey

15:40

GIPC CEO joins Vice President to open new sanitary pad production line

09:23